Five Things You Need to Know About Washington, DC’s Rental Licensing Process

Nest DC

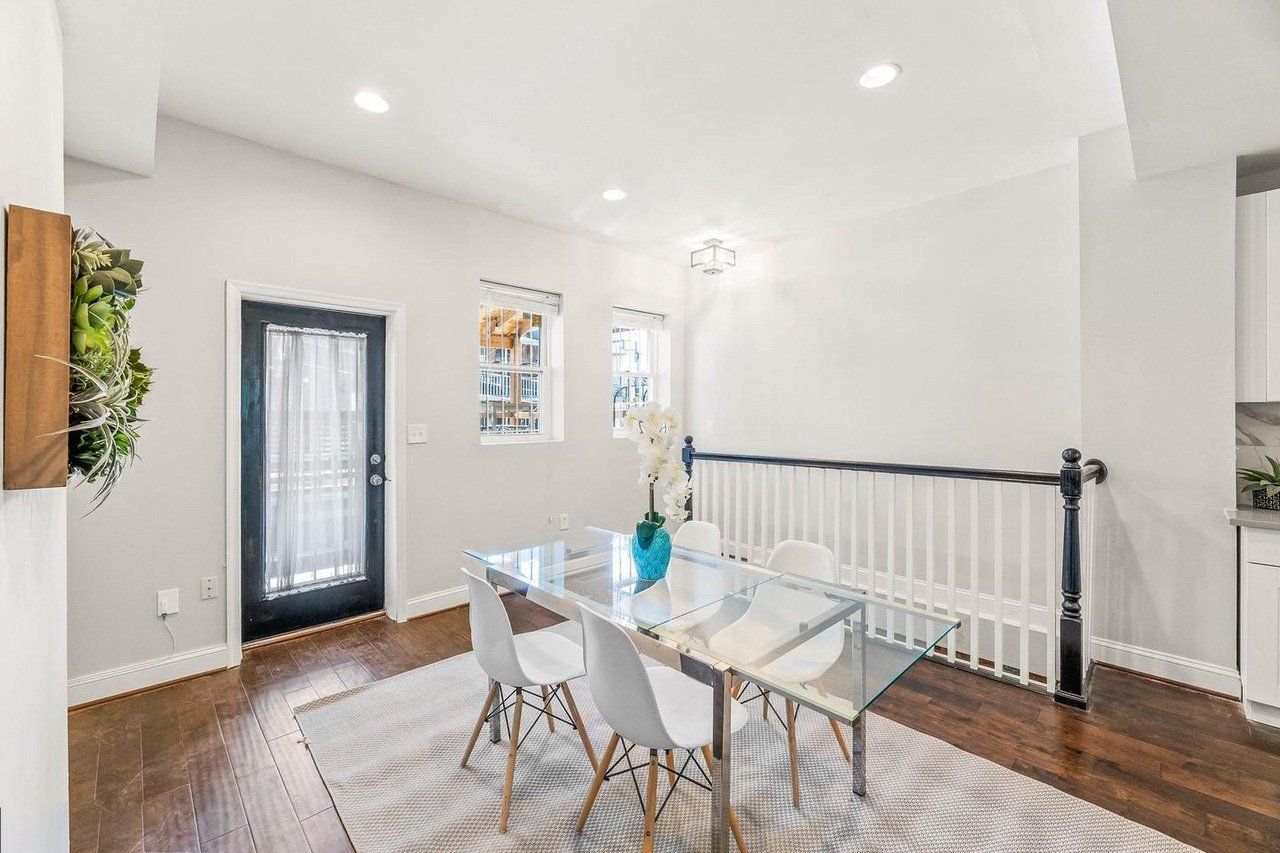

Getting ready to hit the market with your rental property is exciting. Making the decision to rent is a big step, and you may be tempted to list your unit and start accepting applications right away. However, deciding to rent out your property also means you have decided to start a business, and that comes with a few important requirements. If you’re ready to become a housing provider, you’ll need to go through DC’s licensing process first. Here are five things you may not know (yet):

You need a business license, even if you are self-managing

Whether you're managing your rental property on your own or hiring a property manager, you are required by the District of Columbia to have a business license. We often meet with owners who never researched the requirements before renting their property to their first tenant, and we know, it's possible to fly under the radar. We also know that there are serious financial consequences if the city catches you without the proper paperwork on file. A rental property is business; don’t skip this step.

You need to keep track of the expiration date

You can buy a 2-year or a 4-year license in DC. We recommend the longer license if you’re planning on keeping your rental property as a longer-term investment, and you’ll save money year over year. Usually, the city will send you a renewal reminder prior to the expiration date, but these get missed often enough. Even if you have hired a manager to take care of your property, make sure that you are aware of license expiration dates so you don’t end up overdue.

You need a RAD, no matter what

The RAD is your rental exemption form in DC. It’s administered by the Department of Housing and Community Development, which monitors all things related to rent control. Many rental units are exempt from rent control because they were either built after 1975 or are owned by a person (not an LLC) who owns no more than four rental units in the District. Many housing providers meet these requirements and assume they are automatically exempt, but that is not the case. Every housing provider must file a RAD form (Form 1) with DHCD.

You need to withdraw your homestead exemption

Homeowners in Washington, DC qualify for a homestead exemption if the property they are filing it for is their primary residence and the property is five units or less. This is a great tax benefit. So, when the property is no longer your primary residence because you have converted it to a rental property, the homestead exemption no longer applies. You must remember to cancel it or risk an audit and back taxes.

You can hire someone to do almost all of this

If managing rental properties is not your full-time job, spending the time to ensure you’re compliant with DC’s licensing requirements might not be worth it. We know that the initial paperwork can be intimidating and confusing. That’s why we recommend working with a company like BBL Processors to take the heavy lift off your hands. They offer a discount to Nest clients, and we also support throughout the process. Schedule a call with us to get our free BBL guide and recommendations unique to your property.

At Flock, we believe that happy homes make for happy residents, who cultivate strong, local communities that sustain our city, DC. If you’re interested in renting out your property, you might be interested in our post on ‘7 Tax Benefits of Owning a Rental Property in Washington, DC.”